By Jackie, Researcher

Topic: Education

Area of discussion: Management & Cost

Accounting

Chapter: Capital investment decisions –

appraisal methods

The objective of this posting is to share

a ‘question & answer’ related to capital investment decision. A real past

year question was taken from AAT Stage 3 Cost Accounting and Budgeting. I hope

this posting will help more students to understand payback, accounting rate of

return and net present value calculations better. Some parts of it might be

tricky where it tries to confuse students. Besides, normally professional exams

questions will ask a bit on its theoretical concepts or other qualitative

measures. Hopefully, this posting will help students to eliminate the fear in

exams and to score with flying colours.

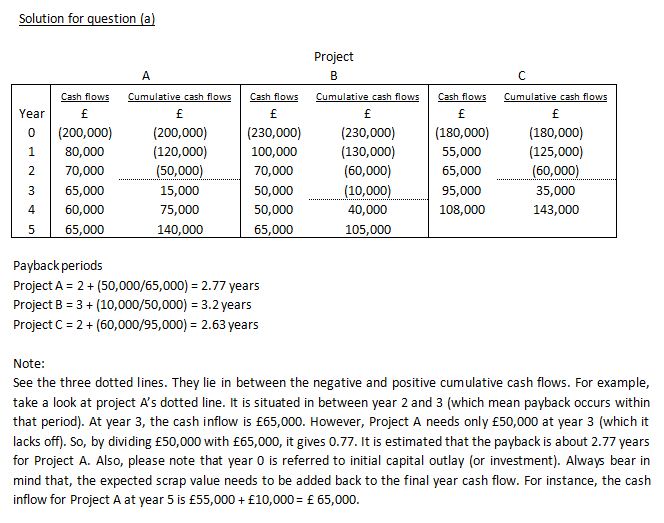

Payback is defined as the length of time

that is required for a stream of cash proceeds from an investment to recover

the original cash outlay required by the investment. If the stream of cash

flows from the investment is constant each year, the payback period can be

calculated by dividing the total initial cash outlay by the amount of the

expected annual cash proceeds. However, if the stream of expected proceeds is

not constant from year to year, the payback period is determined by adding up

the cash inflows expected in successive years until the total is equal to the original

outlay (see below).

Accounting rate of return uses profits rather than cash

flows. Therefore, to find out the profits, we have to take cash flows minus

depreciation. Do not add the scrap value back to the final year’s cash flow.

This is because scrap value is not profit. Remember, if all things are run

accordingly, there will be no ‘gain or loss on disposal’, thus it will not

affect the profits. The average investment under this assumption is one-half of

the amount of the initial investment plus one-half of the scrap value at the

end of the project’s life.

Net present

value (NPV) is computed using net cash inflows less the project’s initial

investment outlay. A positive NPV indicates that an investment should be accepted,

while a negative value indicates that it should be rejected. A zero NPV

calculation indicates that the firm should be indifferent to whether the

project is accepted or rejected.

Normally,

for the last sub-question of the investment appraisal decisions, the examiners

will frequently ask the students on which is the most favorable investment

project. Sometimes, when there is a conflict in ranking between the few

investment appraisal methods, NPV method will be the key decision factor.

Not all

investment projects can be described completely in terms of monetary costs and

benefits. There is also a danger that those aspects of a new investment that

are difficult to quantify may be omitted from the financial appraisal.

Additional

readings, related links and references:

Payback Period: Meaning, Calculation, Example,

Usage and Consideration.

Investment Appraisals: A guide to

calculating ARR, the accounting rate of return.

Net

Present Value (NPV): Tutorials, Calculators, Android Apps, Excel Solutions

& Tables for Finance

Watch a short introduction video

to Investment Appraisal Methods

Hello Chan Hoi..how are U my friend,nice share really I like it great day 4U from INDONESIA with smile.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteDearest Esteems,

ReplyDeleteWe are Offering best Global Financial Service rendered to the general public with maximum satisfaction,maximum risk free. Do not miss this opportunity. Join the most trusted financial institution and secure a legitimate financial empowerment to add meaning to your life/business.

Contact Dr. James Eric Firm via

Email: fastloanoffer34@gmail.com

Whatsapp +918929509036

Best Regards,

Dr. James Eric.

Executive Investment

Consultant./Mediator/Facilitator

doa buka puasa

ReplyDeletebaju raya

niat solat terawih

panduan umrah

baju raya sedondon

You are really a genius. I also run a blog, but I don't have genius skills like you. However, I am also writing hard. If possible, please visit my blog and leave a comment. Thank you. 토토사이트

ReplyDeleteMake tax season stress-free with our expert Personal Tax Return Service. We ensure your returns are accurate, submitted on time, and fully compliant — helping you maximise reliefs and avoid penalties.

ReplyDeleteOutbooks offers expert Company Secretarial & Other Services to help you stay compliant and manage your company’s legal requirements efficiently. Discover more about how we can assist you here.

ReplyDelete