By Jackie,

Researcher

Topic: Education

Area of

discussion: Finance

Chapter: Dividend

policy

Subchapter:

Alternatives to cash dividends – Stock dividend & Stock split

The objectives of this research are to find out what are the major

differences and similarities between stock dividend and stock split, what are

the effects on financial statements when a company issues a stock dividend or a

stock split, how to enter those transaction into the appropriate accounts and the

required adjustment that ought to be made to the financial statements. By the

way, this topic is very popular as questions are often set out from this

chapter in finance examination. Therefore, it is good to actually understand

and gain some knowledge about the basic concept of stock dividend and stock

split although we might not be playing shares in real-life.

Introduction

In term of definition, stock dividend (also known as ‘scrip dividend’)

is a dividend payment made in the form of additional shares, rather than a cash

payout. Ideally, company may decide to distribute stock to shareholders instead

of cash dividend if the company’s cash availability is in unfavourable

condition. These distributions are generally acknowledged in the form of

fractions paid per existing share. An example would be a company issuing a 5%

stock dividend for each single share held. On the other hand, stock split (also

known as ‘scrip issue’, ’bonus issue’ and ‘free issue’) is a corporate action

in which a company existing shares are divided into multiple shares. Although

the number of shares outstanding increases by a specific multiple, the total

dollar value of the shares remains the same compared to pre-split amounts,

because no real value has been added as a result of the split.

Let’s take a look at this example:

.jpg) |

| Question taken from IICS past year examination, also special thanks to Mr.Lim for his kind teachings. |

Solution for (i):

When 10% stock is declared, then the number of shares

outstanding will also be increased by 10%, that is from 10,000 shares to

10,000(1.1)=11,000 shares.

This indirectly indicates that the new share issued is

equal to 1,000 shares.

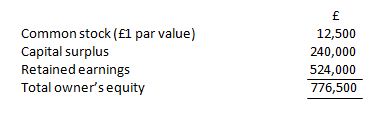

The overall effects on the owner’s equity accounts

are:

Common stock (£1 par value) will increase by £1,000 (£1 par value per share x 1,000 newly issued shares due to 10% stock dividend).

Common stock (£1 par value) will increase by £1,000 (£1 par value per share x 1,000 newly issued shares due to 10% stock dividend).

Capital surplus (also known as ‘share premium’) will

be also increase by £24,000. Please note that share premium is equal to market

price minus the par value. Thus, share premium per share is £25 per share - £1

per share = £24 per share. After that, this share premium per share needs to be

multiplied by 1,000 shares in order to get £24,000 which is the total share

premium due to 10% stock dividend.

Retained earnings will be decreased by £25,000. This

is derived from the market price which is £25 per share, then multiply with

1,000 shares in order to get £25,000.

Solution for (ii):

(This is actually more or less, quite similar with question (i))

When 25% stock is declared, then the number of shares

outstanding will also be increased by 25%, that is from 10,000 shares to

10,000(1.25)=12,500 shares.

This indirectly indicates that the new share issued is

equal to 2,500 shares.

The overall effects on the owner’s equity accounts

are:

Common stock (£1 par value) will increase by £2,500

(£1 par value per share x 2,500 newly issued shares due to 25% stock dividends).

Capital surplus (also known as ‘share premium’) will

be also increase by £60,000. Please note that share premium is equal to market

price minus the par value. Thus, share premium per share is £25 per share - £1

per share = £24 per share. After that, this share premium per share needs to be

multiplied by 2,500 shares in order to get £60,000 which is the total share

premium due to 25% stock dividend.

Retained earnings will be decreased by £62,500. This

is derived from the market price which is £25 per share, and then multiplies

with 2,500 shares in order to get £62,500.

Solution for (iii):

In this case, ‘three-for-one stock

split’ means each existing share is divided into three. Therefore, the shares outstanding after the

stock split will be 30,000 shares (10,000 shares x 3). When this happen the par

value per share will also divided by the split ratio of three, i.e. £1 ÷ 3 =

£0.3333 per share. Hence, these are the only effects of the split.

Please note that the equity accounts

are unchanged except that the par value of the stock is changed by the ratio of

new shares to old shares.

Solution for (iv):

For this question, it is a bit special because it is deal with

‘reverse stock split’, a condition where the shares are combined instead of

splitting according to its ratio. For ‘one-to-five reverse stock split’, it

simply means that for every five existing shares, they are combined into one

share. Thus, 10,000 existing shares will become 2,000 shares after the reverse

stock split (10,000 shares ÷ 5). The par value will change to £5 per share (£1

x 5).

|

| Alteration in owner's equity accounts after a 'one-for-five reverse stock split' is declared |

Extra sharing:

Additional question and answer of which I took from my college past year question, it is solely focus on essay part (the differences). Thus, very theoretical and need deep analytical skills.

|

| This Q&A explains the differences between stock dividend and stock split, their effects on equity accounts and their respective accounting treatment with examples to aid explanation. |

Additional

readings, related links and references:

Part 5:

Stock Splits and Stock Dividends

Chapter

14: Stock Splits and Stock Dividends

Stock

Dividends and How They Are Different From Stock Splits

Chapter

18: Shareholders’ Equity (Stock Dividends and Splits)

The Effect

Of Stock Splits & Stock Dividends On The Market Share Price

A dividend is a portion of profits that a company might decide to pay to its shareholders. Many companies decide to share a percentage of their profits with those who own stock in the company.

ReplyDeleteSingapore dividends

i like info about economic :) keep posting

ReplyDeleteI will share my journey with you on my quest for achieving a sizeable passive income stream. I would achieve that by investing in dividend paying stocks, which have the tendency consistently increase their payments year over year.

ReplyDeletePreferred Stock

Thanks for the post Job Openingz - Online Job Portal | Apply For Jobs OnlineYou should take part in a contest for one of the best blogs on the web. I will recommend this site!

ReplyDeleteNice post..Thanx mate..http://www.financialadvices.in/bonus-shares-vs-stock-split/

ReplyDeleteGreat stuff here. The information and the detail were just perfect. I think that your perspective is deep, its just well thought out and really fantastic to see someone who knows how to put these thoughts down so well.

ReplyDeleteLearn Stock Market

This article perfectly captures student stress during exam weeks and deadlines. Sometimes you just wish someone would do my assignment so you can focus on revisions or get some sleep! But the real value of these services lies in expert support, which offers clarity and sample answers that help you learn. When used wisely, these services can strengthen your understanding and time management. I love how this blog promotes responsible usage rather than over-dependence. It's honest, practical, and incredibly helpful—definitely bookmarking this one!

ReplyDeleteDesignyze is a reliable choice for businesses that want results, not just promises. Their Digital Marketing Agency services bring clarity and performance together.

ReplyDelete